|

health insurance plans for pets explained clearly and calmlyWhat these plans actually doThink of pet insurance as risk-sharing. You pay a premium so that when eligible care gets expensive, the insurer reimburses a portion. Most policies let you visit any licensed veterinarian, submit the invoice, and receive repayment after your deductible and co-insurance. It's helpful, but not magic: waiting periods, exclusions, and caps exist. The goal is accessibility and flexibility, not perfection. Common coverage shapes- Accident-only: Lower cost. Covers injuries like bites, swallowed objects, fractures.

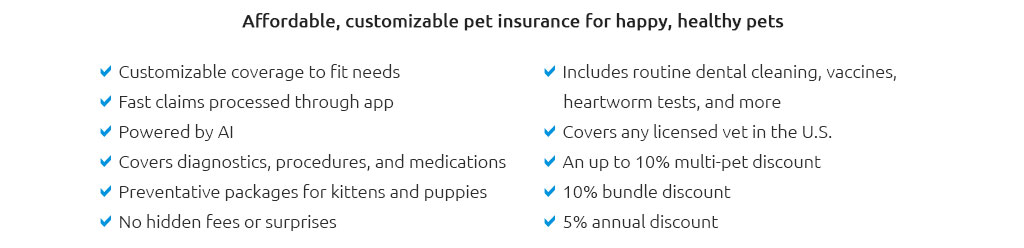

- Accident + illness: The mainstream choice. Includes issues like infections, cancer, GI problems, and many chronic conditions.

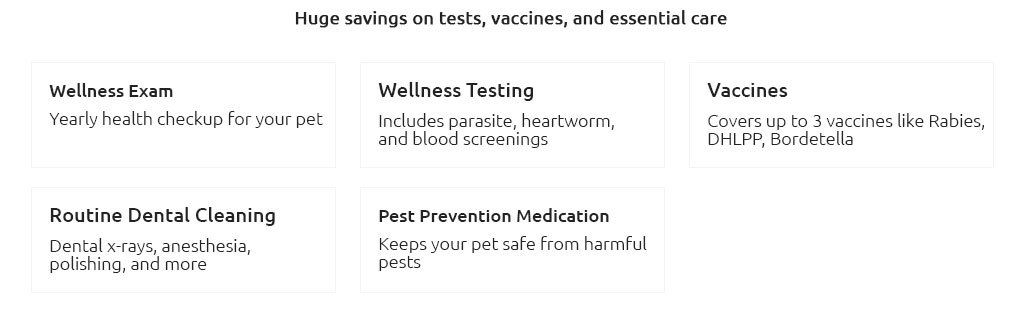

- Comprehensive with wellness add-ons: Routine care (vaccines, exams, dental cleanings) is sometimes available as an optional rider. Handy for budgeters, but it often functions like prepayment.

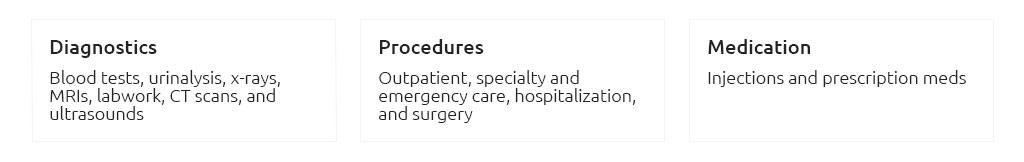

- Prescriptions, diagnostics, and therapies: Imaging, lab work, meds, rehab, and alternative therapies may be included or optional; read the fine print.

Costs you can dial inPlans are flexible; you can balance monthly cost versus coverage strength. - Deductible (annual or per-incident): Higher deductible = lower premium.

- Reimbursement rate (often 70 - 90%): Higher rate = more paid back, higher premium.

- Annual limit: From a few thousand to unlimited. Lower limit trims cost but caps protection.

- Co-pay/co-insurance: Your share after the deductible. Influences premiums and risk.

Accessibility levers- Multi-pet discounts and occasional promotions through shelters or employers.

- Age and breed affect cost; enrolling earlier typically expands options.

- Direct pay is rare but growing with some ER and specialty hospitals; most claims reimburse you after payment.

A brief real-world momentAt 11 p.m., Maya's terrier swallowed a sock. Emergency surgery ran about $2,300. With a $250 annual deductible and 80% reimbursement, she received roughly $1,640 back. Not every claim lands this neatly, but the plan softened a stressful night. How to compare without getting lost- List your risks: Young indoor cat? Accident-only might suffice. Athletic dog or breed with known conditions? Consider broader illness coverage and a higher annual limit.

- Check exclusions: Pre-existing conditions, bilateral issues, breed-specific limits, dental disease, and behavior/alternative therapies vary widely.

- Read waiting periods: Accidents may start sooner than illnesses; cruciate and hip issues often have longer waits.

- Estimate a bad year: Price out an emergency visit plus imaging or surgery in your area, then see how each plan would respond under your chosen settings.

- Test the claims experience: Look for average processing times, required documentation, and whether exam fees are covered.

Expectations to set early- It's a budgeting tool, not a guaranteed savings plan. Some years you may "lose" on premiums; the tradeoff is protection from rare but large bills.

- Rates can rise as pets age and vet costs increase. Build room in your budget.

- Wellness add-ons are for predictability, not usually value-maximizing.

- Pre-existing conditions are typically excluded, including symptoms noted before enrollment.

- Claims are not instant. Expect a short delay; keep emergency funds for up-front payment.

Flexibility for different lifestylesUrban apartment with an indoor cat? A modest plan with a higher deductible may keep premiums accessible. Weekend trail dog or frequent traveler? Consider a higher annual limit and rehab coverage. Seniors and rescues can still be insured, though costs rise; choosing a balanced reimbursement rate often preserves affordability without losing essential protection. Bottom linePick settings that fit your comfort with risk: an annual deductible you can cover, a reimbursement rate that feels fair, and a limit that covers one serious event. Aim for steady, predictable support and accept a few gaps. With clear expectations, health insurance plans for pets can offer flexible, accessible peace of mind without overpromising.

|

|